interest tax shield formula

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

Interest Tax Shield Formula And Excel Calculator

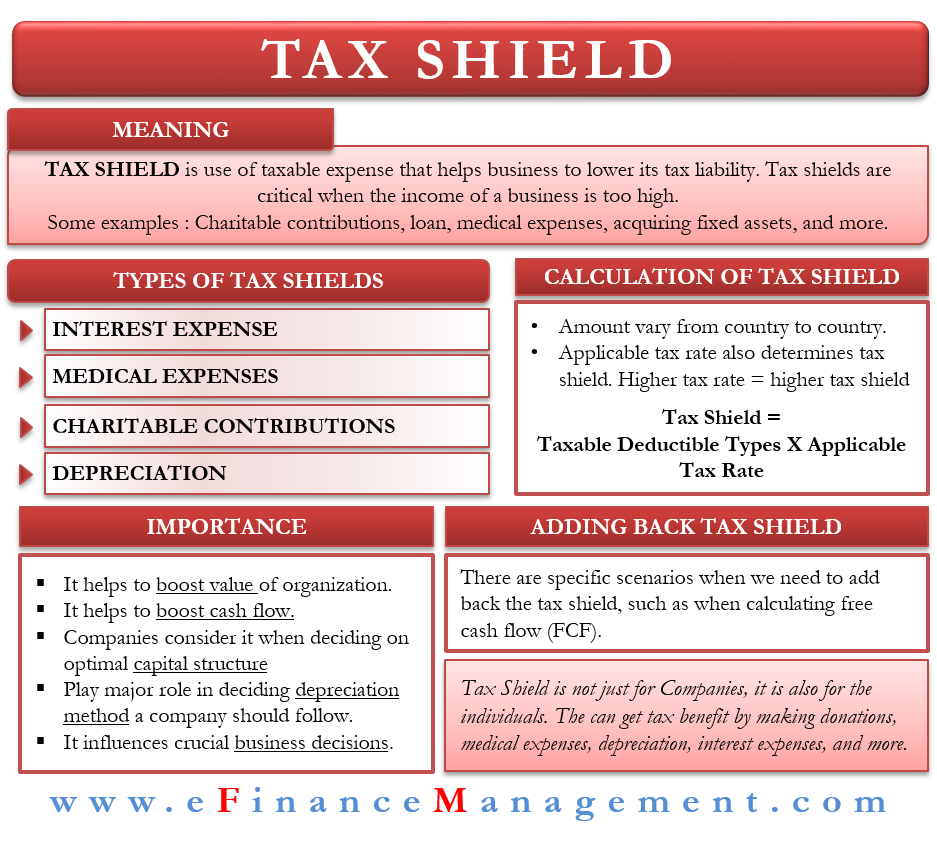

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense.

. Firstly determine the outstanding loan amount extended to the borrower and it is denoted by P. The reason why the pre-tax cost of debt must be tax-affected is due to the fact that interest is tax-deductible which effectively creates a tax shield ie. To compute compound interest we need to follow the below steps.

Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield. Simple Interest 1625 Therefore the 2 nd option is the cheaper one despite higher interest rates because the 1 st option is more expensive due to annual compounding. Here is the formula to calculate interest on the income statement.

This is usually the deduction multiplied by the tax rate. Interest Tax Shield Example. Find out the initial principal amount that is required to be invested.

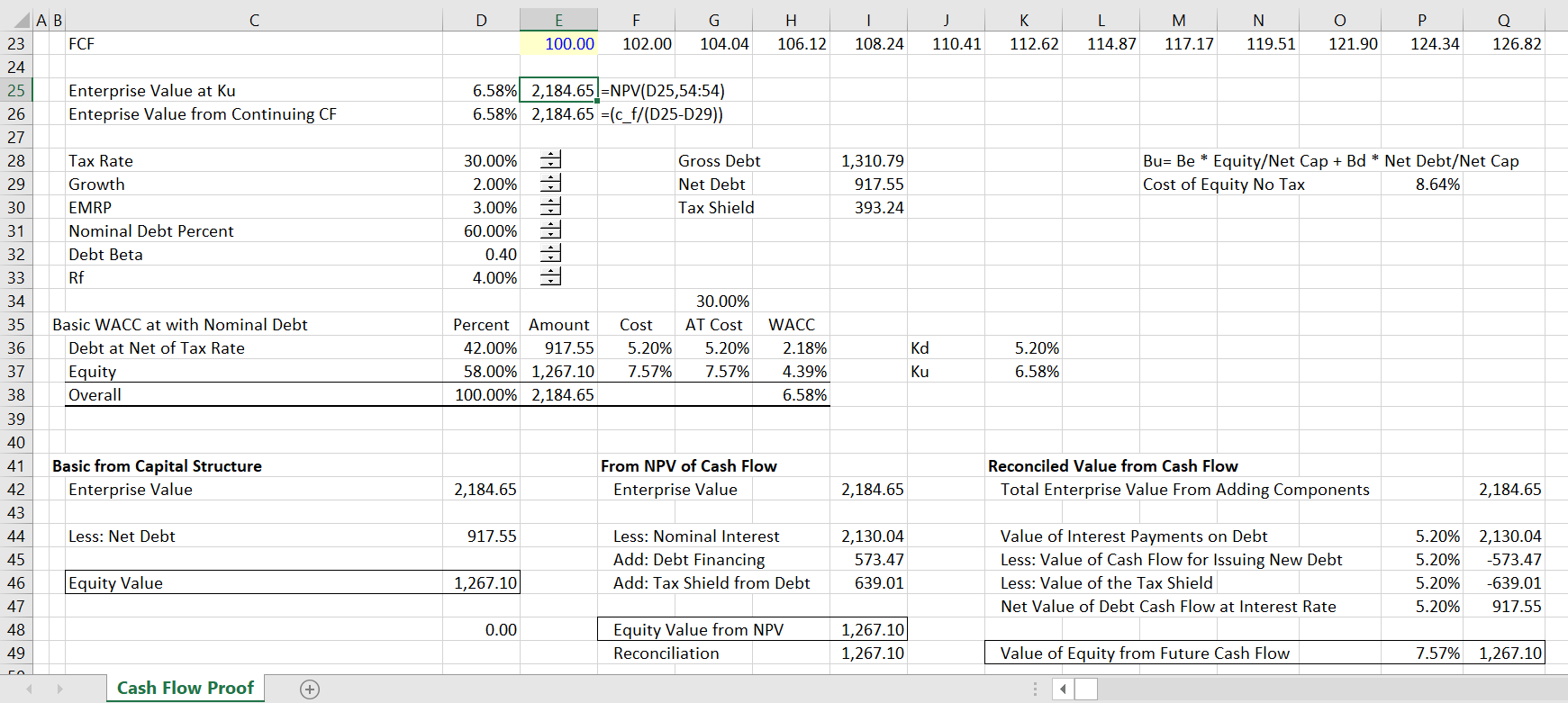

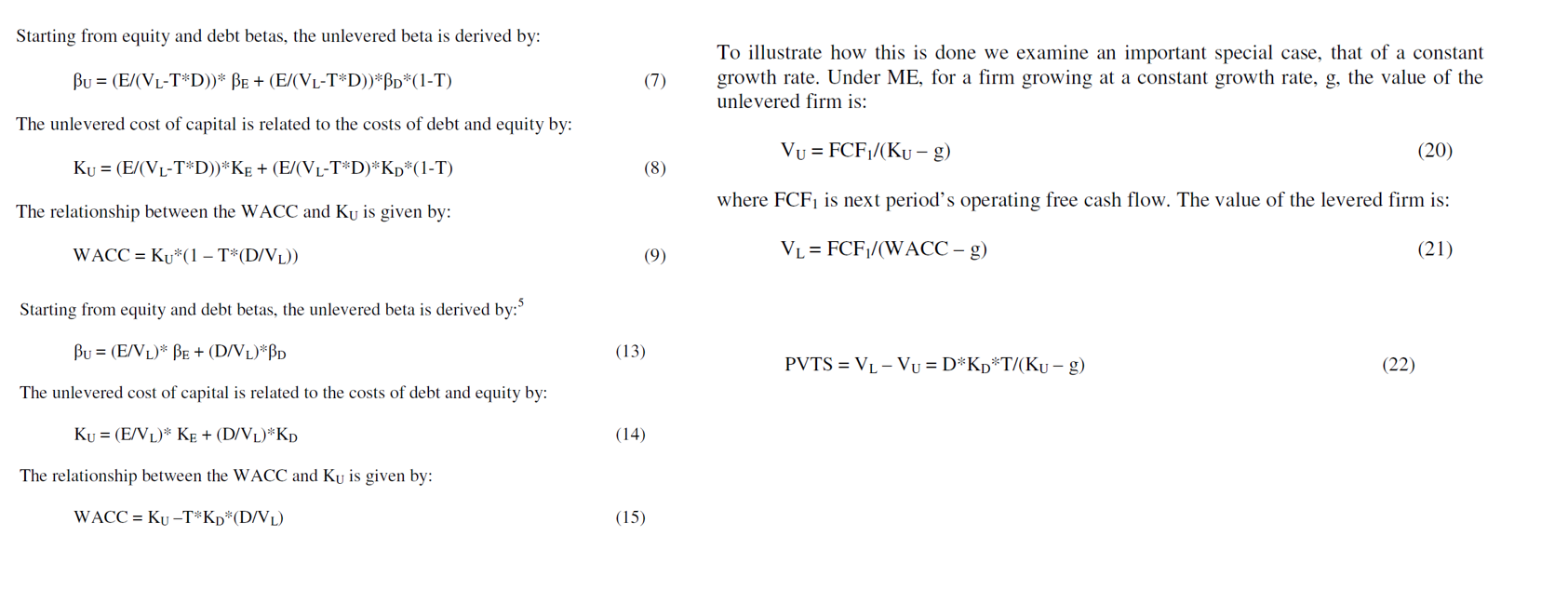

Thus there is a tax savings referred to as the tax shield. Following are the steps to calculate Simple Interest. Notice in the Weighted Average Cost of Capital WACC formula above that the cost of debt is adjusted lower to reflect the companys tax rate.

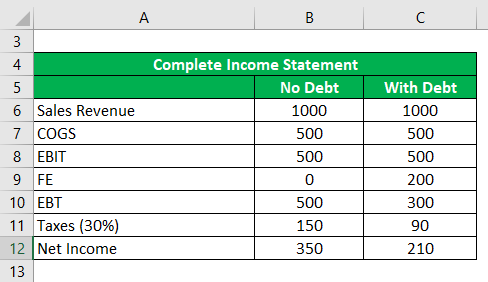

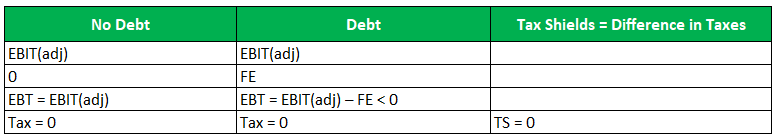

Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. If a company has zero debt and EBT of 1 million with a tax rate of 30 their taxes payable will be 300000. Thats because the interest payments companies make are tax deductible.

Damodaran Online publishes a table that lets you map a credit rating based on interest coverage. The interest expense reduces the taxable income earnings before taxes or EBT of a company. AfterTax Cost of Debt Formula.

Tax Shield Deduction x Tax Rate. The effect of a tax shield can be determined using a formula. 60 1 Compound Interest Explanation.

To learn more launch our free accounting and finance courses. Interest Expense Formula.

Tax Shield Formula How To Calculate Tax Shield With Example

Operating Cash Flow Definition Examples Video Lesson Transcript Study Com

Tax Shield Formula Step By Step Calculation With Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Modigliani And Miller Part 2 Youtube

Berk Chapter 15 Debt And Taxes

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

Interest Tax Shield Formula And Excel Calculator